Regeneron acquires 23andMe to access DNA profiling IP

Regeneron Inc has announced it has entered into an Asset Purchase Agreement to acquire 23andMe for US$ 256 Million.

The planned purchase aims to strengthen Regeneron’s ongoing leadership in genetics-guided research and drug development to help people with serious diseases.

Regeneron has stated that it plans to:

- maintain the consumer genetics business

- advance shared goals of improving human health and wellness

- prioritise the privacy, security and ethical use of 23andMe’s customer data

23andMe will be operated as a wholly owned direct or indirect subsidiary of Regeneron Pharmaceuticals, Inc. and continue operations as a personal genomics service.

Pending bankruptcy court and regulatory approvals, the deal is expected to close in Q3 2025.

Company Profiles:

23andMe, is a leading consumer genetics and research company. Founded in 2006, the company has pioneered direct access to genetic information and the only company with multiple FDA clearances for genetic health reports. 23andMe state they have built the world’s largest crowdsourced platform for genetic research, with 80 percent of our customers electing to participate. 23andMe's Therapeutics team uses this research platform to identify and develop drug targets rooted in human genetics across a spectrum of disease areas, including oncology, respiratory, and cardiovascular diseases.

Source: www.23andme.com.

Regeneron (NASDAQ: REGN), headquartered in Tarrytown, New York, US, is a biotechnology company that invents, develops and commercialises life-transforming medicines for people with serious diseases. Our medicines and pipeline are designed to help patients with eye diseases, allergic and inflammatory diseases, cancer, cardiovascular and metabolic diseases, neurological diseases, hematologic conditions, infectious diseases, and rare diseases.

Source: www.regeneron.com

Regeneron seeks to be seen as a safe custodian of DNA data

George D. Yancopoulos, co-Founder, Board co-Chair, President and Chief Scientific Officer of Regeneron, said:

“Through our Regeneron Genetics Center, we have a proven track record of safeguarding personal genetic data, and we assure 23andMe customers that we will apply our high standards for safety and integrity to their data and ongoing consumer genetic services. We believe we can help 23andMe deliver and build upon its mission to help people learn about their own DNA and how to improve their personal health, while furthering Regeneron’s efforts to improve the health and wellness of many.”

Beyond data security, this acquisition signals Regeneron’s intent to leverage 23andMe’s genetic data—and by extension its patent portfolio—into therapeutic pipelines.

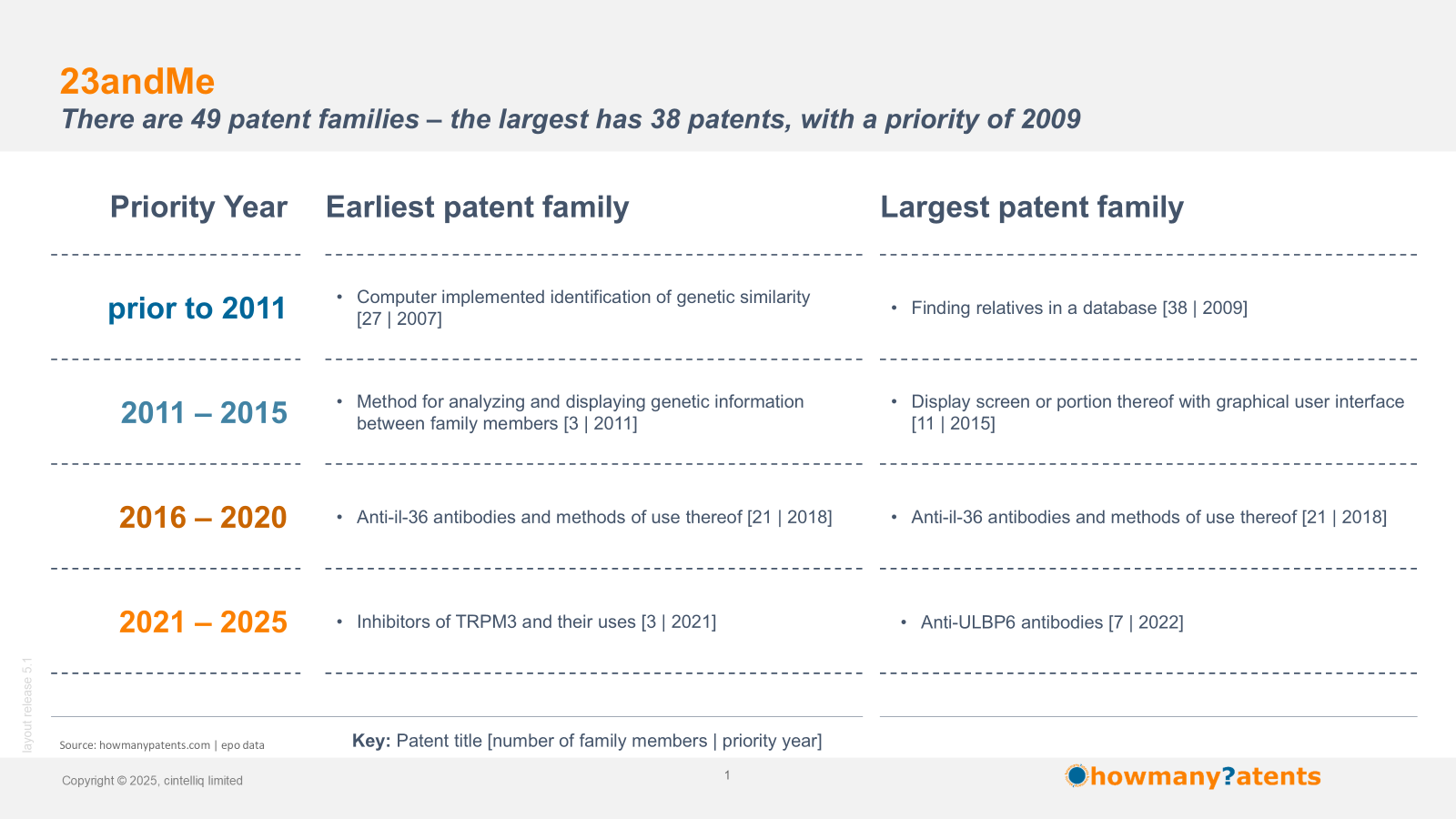

23andMe's patent portfolio started small then expanded rapidly after 2019

23andMe's patent portfolio started small but saw rapid growth after 2019. By March 2025, the company had built up 49 patent families, with 231 applications filed and 89 granted patents. The first decade (2007–2017) was relatively uneventful, as the number of patents published each year gradually decreased. This trend clearly shows in the chart below. But from 2019 onward, there was a significant increase in patent activity, with granted patents following similar growth.

23andMe’s patent filings have largely concentrated on the US market

Eighty percent of 23andMe’s applications are filed with just three patent offices: the USPTO (US), the World Intellectual Property Organisation (WO/PCT), and the European Patent Office (EPO).

23andMe has filed 134 patent applications at the USPTO, 30 patents under WO (PCT), and 21 at the European Patent Office.

Nearly all granted patents (96.6%) are US patents—86 out of 89. The remaining granted patents include two in Europe and one in South Africa.

Over time their innovation focus has shifted

Since 2018, 23andMe’s filings have steadily pivoted away from genealogy toward drug-discovery innovations.

The chart below shows the number of patents filed each year between 2007 and 2023. There are periods 2007-2009 and 2018-2020 where there was significant patent filing activity.

Most granted patents derive from genealogy inventions filed between 2007 and 2012.

Number of patents by filing year

Examining published patents by when they were filed (priority grouping) shows this more clearly, as seen in the chart below. While the number of granted patents is increasing, most are based on inventions filed prior to 2010.

Number of patents and priority groupings by publication year

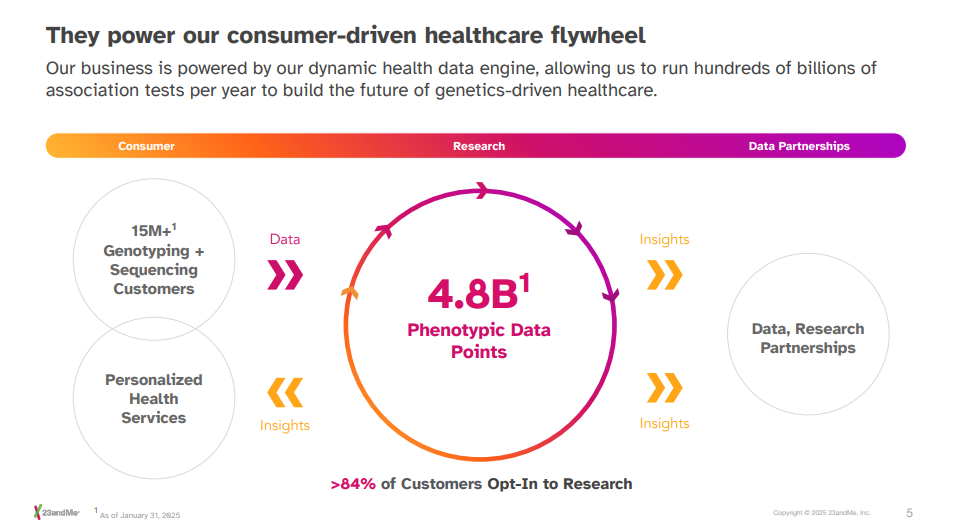

Consumer-driven healthcare flywheel

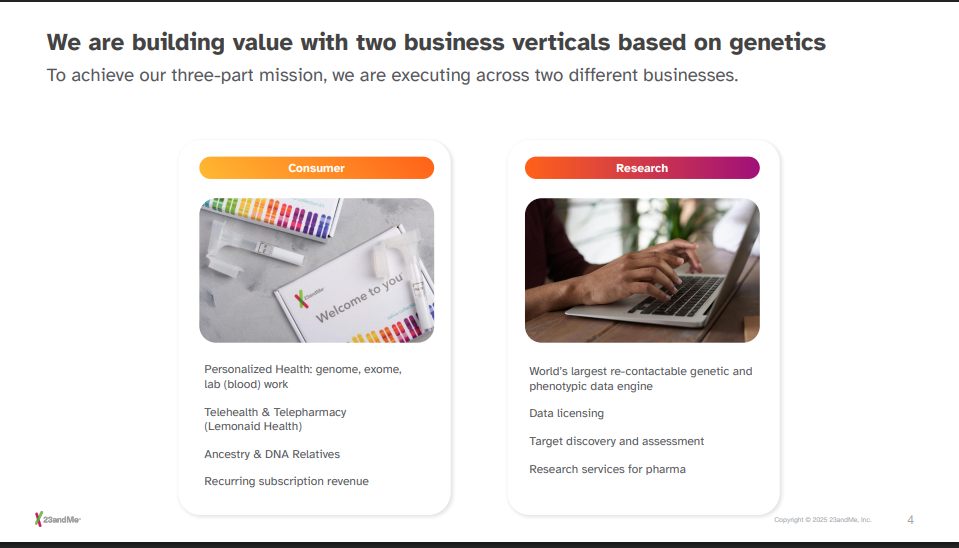

In the company's recent investor report, they outline two business models in play.

The company sees these models working together as a consumer-driven healthcare flywheel.

Clearly, the two models operate in synergy—but one is more vulnerable than the other when it comes to IP.

Innovation patent pipeline under pressure

The company’s largest rival, Ancestry.com, claims to have the world’s largest DNA database, with 25 million entries.

Ancestry.com's patent portfolio is also larger than 23andMe's. By March 2025, the company had built up 148 patent families, with 511 applications filed and 182 granted patents.

Another noticeable difference is the age of the patent portfolio. The majority of Ancestry.com's patents have been filed since 2016, giving them a larger and younger portfolio.

Patents typically have a 20-year lifespan, so those early applications filed in 2007 may be nearing expiry, assuming they haven’t already been abandoned. As these genealogy-focused patents lapse, 23andMe could lose ground in that segment—especially compared to competitors.

This raises a key question: "Will 23andMe need to refresh its Personal Genome Service IP to stay competitive with Ancestry.com?"

Sources and notes:

Sources:

Regeneron press release:

23andMe Investor Presentation - 2025-02-05:

https://investors.23andme.com/static-files/c5b02f5f-eb63-40ea-bd02-0f44f0074fc5

Notes:

Publication Date vs. Filing Date

There is a distinct difference between a patent’s filing date and its publication date. The filing date is when the patent application is officially submitted to the Patent Office, establishing who has priority for the invention. The publication date is when the details of the invention are first made public, usually 18 months after filing. This distinction matters because the filing date affects patent rights and legal protection, while the publication date determines when the invention becomes public and counts as prior art for future patents.

Patent Families

In our analysis, we use the concept of a simple patent family. Understanding the difference between simple and extended families helps identify how widely an invention is protected across countries and related filings.

- Simple family: Also known as the DOCDB family, this is a group of patent documents that all originate directly from a single priority filing. It represents the same invention filed in different countries, following a straightforward lineage.

- Extended family: Also known as the INPADOC family, this includes all patents linked through a chain of priority claims—even if they don’t share exactly the same initial filing—offering a broader view of related inventions.

EPO definitions