IonQ to acquire Oxford Ionics: IP play, market access—or something more?

IonQ and Oxford Ionics have announced they have entered into a definitive agreement for IonQ to acquire Oxford Ionics in a transaction valued at US$1.075 billion, which will consist of US$1.065 billion in shares of IonQ common stock and approximately US$10 million in cash (subject to customary closing adjustments and expenses).

According to the announcement this transaction:-

- will bring together IonQ’s quantum compute, application and networking stack with Oxford Ionics’ ion-trap technology manufactured on standard semiconductor chips

- will combine both companies' technologies aiming to deliver innovative, reliable quantum computers that increase in power, scale, and problem-solving capabilities

- will see both companies seek to benefit from the other’s complementary technologies, deep expertise, and IonQ’s global resources and established customer base

The combined company:-

- expects to build systems with 256 physical qubits at accuracies of 99.99% by 2026 and advance to over 10,000 physical qubits with logical accuracies of 99.99999% by 2027

- anticipates extending its innovation by reaching 2 million physical qubits in its quantum computers by 2030, enabling logical qubit accuracies exceeding 99.9999999999%

According to IonQ, the combined company expects

- to maintain all existing customer relationships, including government partnerships in both the UK and US

- to continue working with the UK National Quantum Computing Centre and the government's Quantum Missions program, driven by the Department for Science, Innovation and Technology and Innovate UK, helping to develop practical quantum computing applications in manufacturing, pharmaceuticals, and defence.

The acquisition of Oxford Ionics follows IonQ’s recent quantum computing and networking momentum, including the recent acquisition of Lightsynq and pending acquisition of Capella.

In brief:

- IonQ will acquire Oxford Ionics for US$1.075 billion, comprising mostly shares and some cash.

- Oxford Ionics brings a 19-family patent portfolio, technical team, and UK base.

- The IP centres on photonic integration with trapped-ion systems, including scalable chip designs.

- Most filings are in the UK and Europe, with limited geographic spread to date.

- The deal raises the question: why acquire a start-up with only 3 granted patents?

Company Profiles:

IonQ, Founded in 2015 and headquartered in College Park, Maryland, IonQ is a leader in trapped‑ion quantum computing and networking, delivering systems such as the IonQ Forte, offering 36 algorithmic qubits on major cloud platforms [1].

Source: ionq.com/

Oxford Ionics, Co‑founded in 2019 by Dr Chris Ballance and Dr Tom Harty, the Oxford‑based spin‑out employs 80 experts across physics, quantum architecture, engineering, and software, and holds world records in gate fidelity and SPAM performance [1].

The company also maintains strong partnerships across the UK’s public quantum sector, including the National Quantum Computing Centre and Innovate UK.

Source: oxionics.com

Oxford Ionics' ion-trap-on-a-chip technology set to accelerate IonQ’s commercialisation plans

“IonQ’s vision has always been to drive real-world impact in every era and year of quantum computing’s growth. Today’s announcement of our intention to acquire Oxford Ionics accelerates our mission to full fault-tolerant quantum computers with 2 million physical qubits and 80,000 logical qubits by 2030”

“We believe the advantages of our combined technologies will set a new standard within quantum computing and deliver superior value for our customers through market-leading enterprise applications."

“We are pleased to welcome Oxford Ionics founders Dr. Chris Ballance and Dr. Tom Harty, and the rest of the Oxford Ionics team to IonQ. Their groundbreaking ion-trap-on-a-chip technology will accelerate IonQ’s commercial quantum computer miniaturization and global delivery. Our combined path to millions of qubits by 2030 will help ensure unit economics, scale, and power as quantum computing rapidly evolves.”

Niccolo de Masi, CEO of IonQ

Oxford Ionics patent portfolio is small, but growing

Acquiring Oxford Ionics also gives IonQ access to their patent portfolio. Oxford Ionics' portfolio consists of 19 patent families, 38 patent applications and 3 granted patents. First patents were published in 2021, but the earliest application has a priority of 2020.

Their patent portfolio is UK centric

Oxford Ionics has filed the majority of the patents with the UK IPO. Twenty-three have been filed with the UK IPO (GB), six filed with WIPO (WO), four with Australia IP (AU), three with the EPO (EP) and 2 with the USPTO.

Patent applications filing started in 2020. There was significant growth in applications in both 2022 and 2024

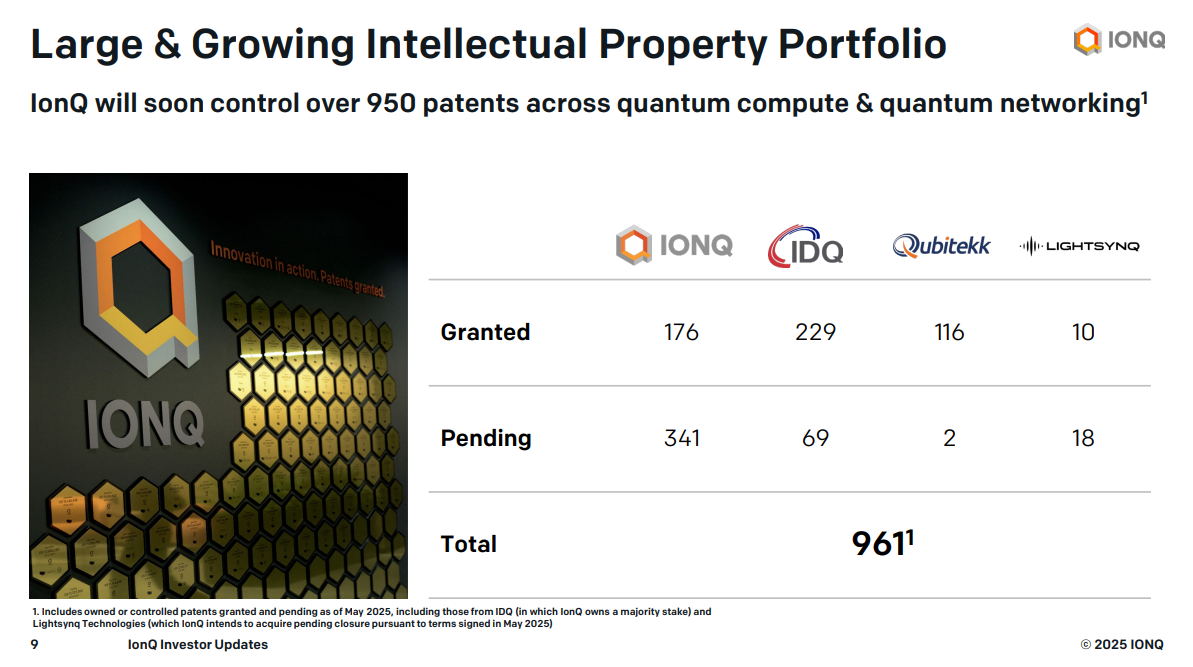

IonQ patent portfolio substantially larger than Oxford Ionics'

IonQ began filing patents just a year before Oxford Ionics. However, IonQ's patent portfolio is substantially larger than Oxford Ionics'. Since 2019 IonQ has accumulated a patent portfolio consisting of 375 patent applications, and 105 granted patents, across 158 patent families.

IonQ's largest patent family - 199 patent applications - is titled:

IonQ see their growing patent portfolio as important to share in their investor updates

The Oxford Ionics patent portfolio is not the smallest it has acquired.

Why acquire a start-up with only 3 granted patents?

At first glance, Oxford Ionics’ patent portfolio looks modest: 19 families, 38 applications, and only 3 grants. IonQ’s own portfolio is more than 10 times larger.

So why a deal worth over US$1 billion?

There are three strategic possibilities—each pointing to a different theory of value:

- The IP is critical

Oxford Ionics’ core patents—especially those covering its ion-trap-on-a-chip design—may be fundamental to commercialising scalable, fault-tolerant ion-trap systems. If so, US$1 billion could be a justified price to secure essential architecture. - The IP is important, but this is about blocking

Even if the IP isn’t essential, it may be strategically useful. The acquisition could prevent a competitor from accessing Oxford Ionics’ platform and team, limiting future competition in the trapped-ion segment. - The IP supports a wider market access play

Beyond patents, Oxford Ionics offers strong links into the UK’s national quantum programmes and technical talent pool. The acquisition may help IonQ build out regional partnerships and delivery capabilities—especially in areas where public–private alignment is critical.

Even when the IP isn’t the headline, it can signal where technical and competitive priorities are converging. It will be worth watching how both companies' patent portfolios evolve post-deal—especially as IonQ moves toward its 2030 targets.

References

[1] IonQ Announces Agreement to Acquire Oxford Ionics. Oxford Ionics. 9 June 2025. https://www.oxionics.com/announcements/ionq-announces-agreement-to-acquire-oxford-ionics